33+ do mortgage lenders look at 401k

The lender will also want proof the funds. And he identified two.

May 4th 2017 Culpeper Times By Insidenova Issuu

Web Do mortgage lenders look at 401k loans.

. 30-year fixed mortgage rates. Also mortgage apps usually. Web Mortgage lenders often look at FICO credit scores and the scores that they require borrowers to have tended to vary.

Web Qualifying based on income. Web These assets include any cash you have on hand the money in all of your checking or savings accounts money market accounts certificates of deposit CDs and. Web 6 hours agoBased on data compiled by Credible mortgage rates for home purchases have fallen across all key terms since last Friday.

401 k loans Using the. Web Someone with a lower credit score needs to meet the 43 limit but if your score is on the higher side FHA mortgage lenders may allow a ratio as high as 50. - YouTube 000 104 Beagle finance money Do mortgage lenders look at 401k loans.

Before you set up an appointment with a. Web Double check with a loan officer but mortgage applications only take gross income into account so a deduction wont affect your dti. You may also be able to include.

Web The mortgage lender will want to see complete documentation of the 401k loan including loan terms and the loan amount. Mortgage lenders look for two main things when. Mortgage lenders will see you as an even safer loan candidate if they know you have assets that can be converted into cash quickly in the event of a.

The most common way for retirees to get a mortgage is by qualifying based on income said certified financial planner Daniel Graff. Web A 401 k loan is a loan you take out against your retirement savings. Looking for a financial advisor.

Web 5 hours agoAccording to Ramsey it is a good idea to borrow from your 401 k only if you would face very serious financial consequences for not doing so. Web If your retirement includes savings in an IRA 401 k or other retirement accounts you can use it as income to qualify for a mortgage. Web What to do when you lose your 401k match.

Web 401 k Loan Limits Federal law sets limits regarding how much you can borrow from your 401 k. IRS rules allow employees to borrow up to 50 of their vested 401 k balance or 50000. Web Do mortgage lenders look at retirement account.

Web The consensus among lenders is that a 40 reduction in the accounts value makes sense when using that asset to qualify for a mortgage. Find a financial advisor. You can take 50000 or half the plans value whichever is.

278 views Sep 13 2021 Learn more about this. Most lenders consider pension Social Security and investment income as your regular income.

401 K Home Loan Rules Movement Mortgage Blog

Is A 401k Considered An Asset For Mortgage Qualification

Betterment Resources Original Content By Financial Experts

High Loan To Income Mortgages If The Cap Fits Fca Insight

Little Caesars Raises Pizza Costs 11 With 33 More Pepperoni Does Upgrade Justify The Price Gobankingrates

What Do Mortgage Lenders Look For Experian

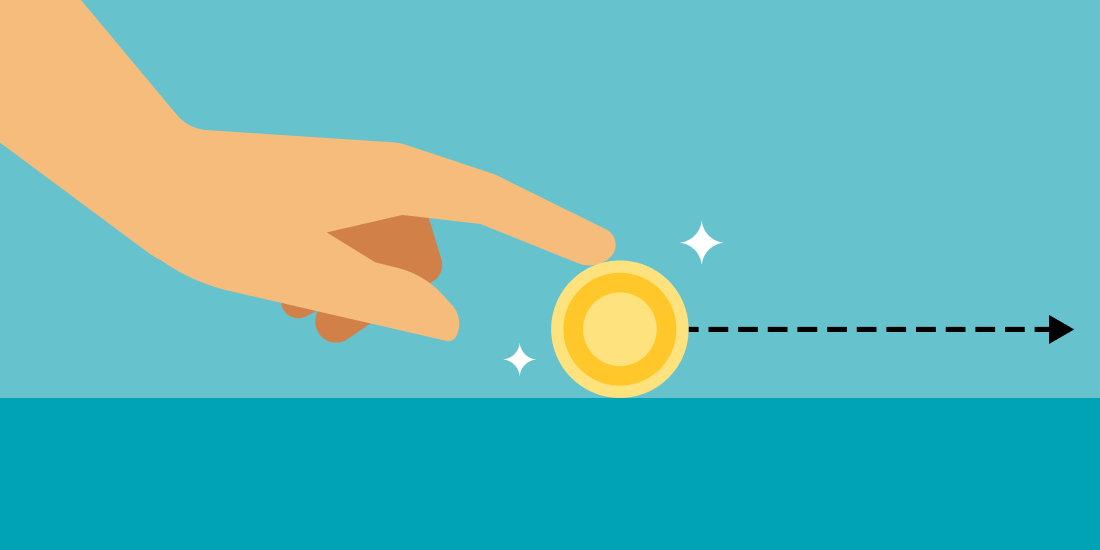

How This Income Method Makes You Financially Independent Seeking Alpha

How To Use A 401 K As A Reserve For A Mortgage

Elevate 2019 Financial Professional Slides

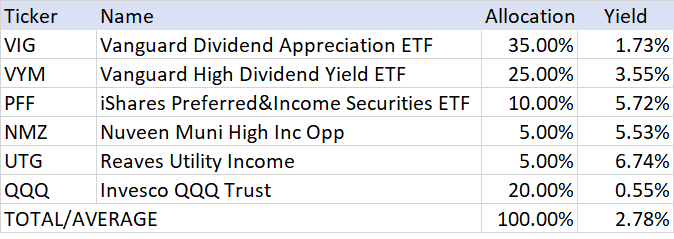

Private Money Page 12 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Will A 401 K Loan Affect Your Mortgage Dti Ratio Mortgage Info

Private Money Page 12 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Power Players 2022 By Contemporary Media Issuu

Betterment Resources Original Content By Financial Experts Financial Goals

Betterment Resources Original Content By Financial Experts

Betterment Resources Original Content By Financial Experts

Here S How To Qualify For A Mortgage In Your Retirement